i was in the same boat 10 years ago...

started working, had no credit card, no phone contract etc.

TElkom + edgards declined me credit.

so after few months of working, and having some money in an fnb cheq acc, i applied for a credit card with fnb...

after few months i was able to apply for a phone contract.

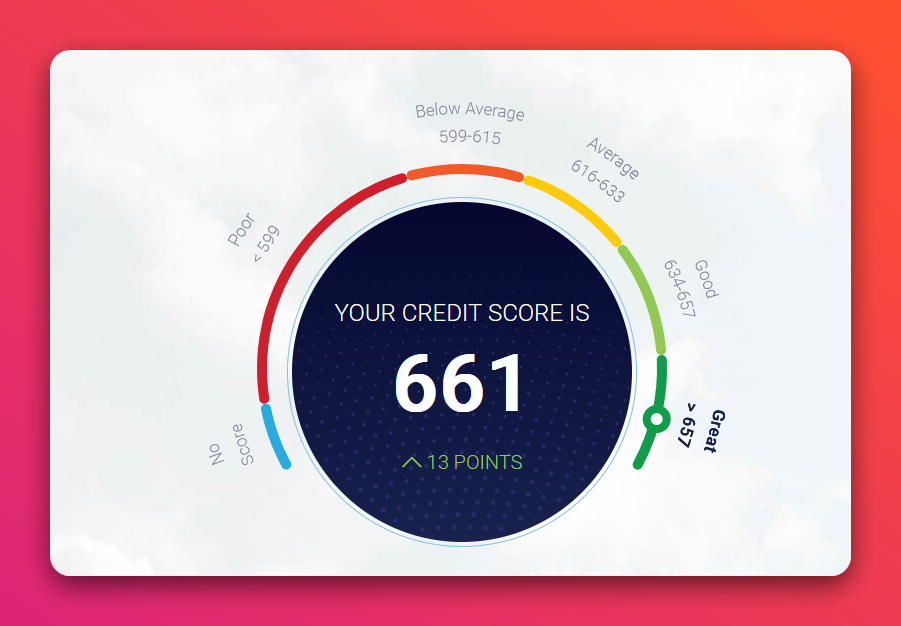

register on mycreditcheck.co.za , and you will see what credit products you have.

started working, had no credit card, no phone contract etc.

TElkom + edgards declined me credit.

so after few months of working, and having some money in an fnb cheq acc, i applied for a credit card with fnb...

after few months i was able to apply for a phone contract.

register on mycreditcheck.co.za , and you will see what credit products you have.